Home Working Allowance for Self-employed

The homeworking allowance allows you to claim back certain expenses to cover the costs incurred when working from your home. These include:

- Room space

- Gas and Electricity

- Phone Bills

Exempt expenses would include anything that is for personal use.

Method 1 – Apportion actual costs

As a self-employed individual working from home, you can choose to divide the business use of your house and bills, in order to get an accurate figure of how much you can claim back.

Method 2 – Flat rate

Alternatively, you can use a flat rate method that was introduced by HMRC to simplify the process.

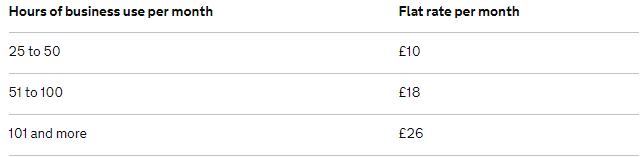

You are only eligible for flat rate expenses if you work for more than 25 business hours per month. The amount you can claim increases dependent on the number of hours worked. (See table below)

This flat rate does not include telephone or internet expenses, so the business element of these can be claimed.

Contact

You may also like…

Directors loan account

SEISS the fifth grant

Company car tax

Stock transfers during COVID

COVID self-assessments deadline

Returning to work