Managing Your Letting Statements in QuickBooks Online

Letting agents typically deduct their fees directly from your rental income and deposit the net amount into your bank account. Here’s a quick guide on how to handle these transactions in QuickBooks Online.

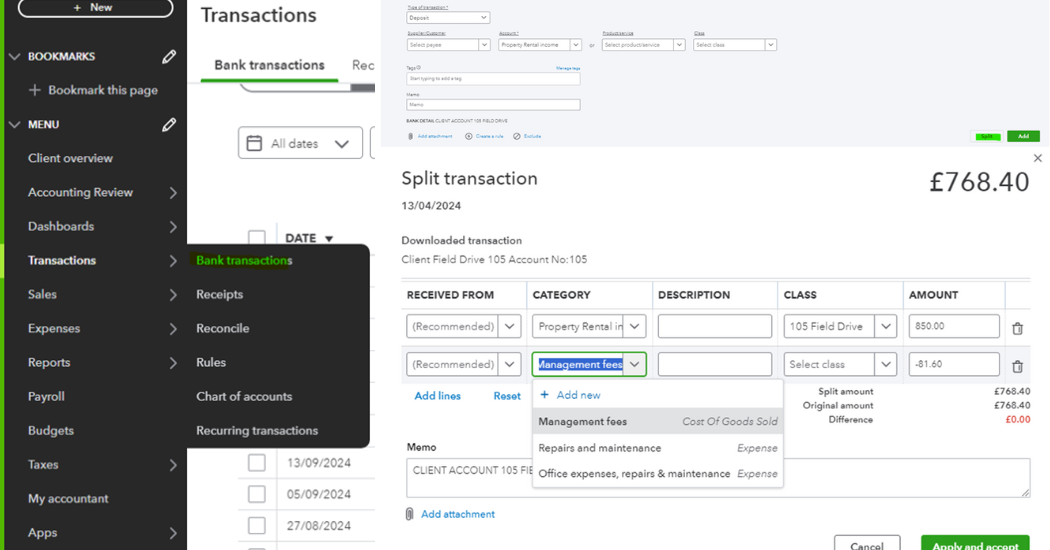

- In QuickBooks, go to the left-hand menu and click on Transactions.

- Next, select Bank transactions to view your recent transactions and begin categorizing the rental income and letting agent fees accurately.

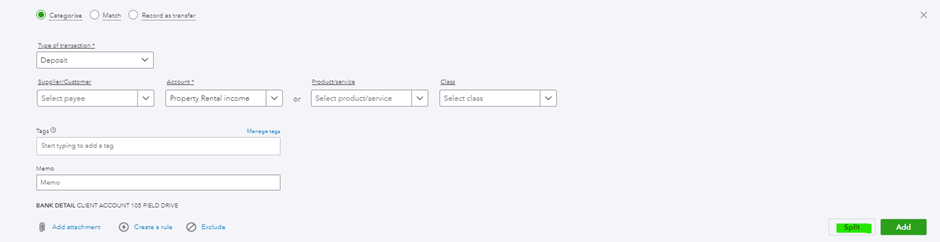

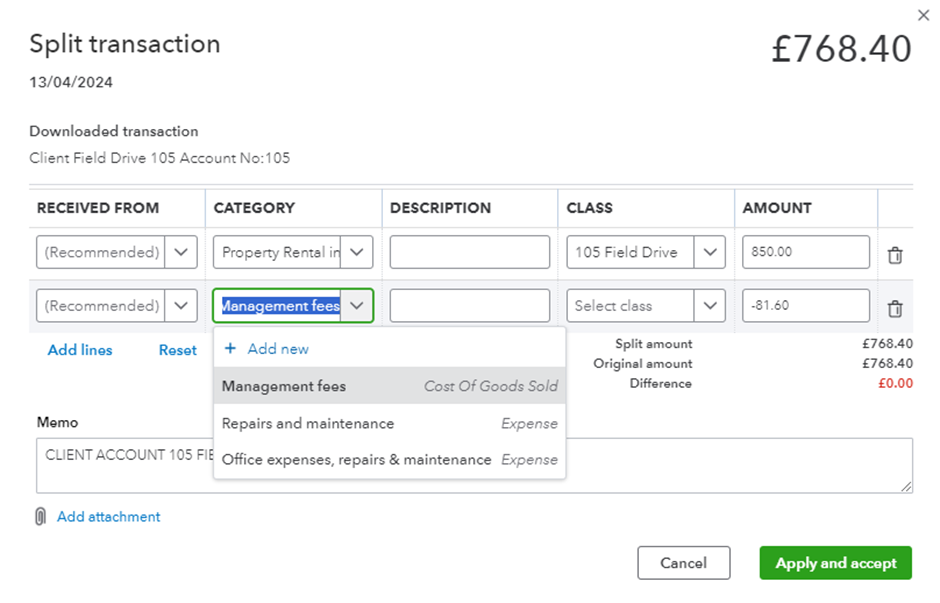

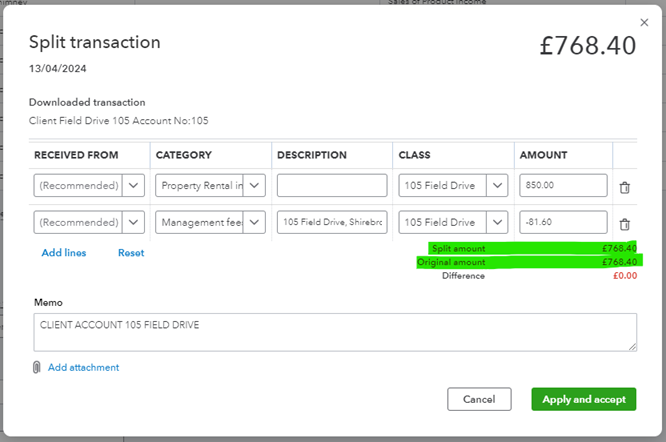

You will then see the net amount reflected in your bank account, and you’ll need to select the option to Split the transaction.

Next, you’ll need to add the gross income as indicated in the letting statement. Fill out the columns for Supplier/Customer, Description, Class, and Amount accordingly.

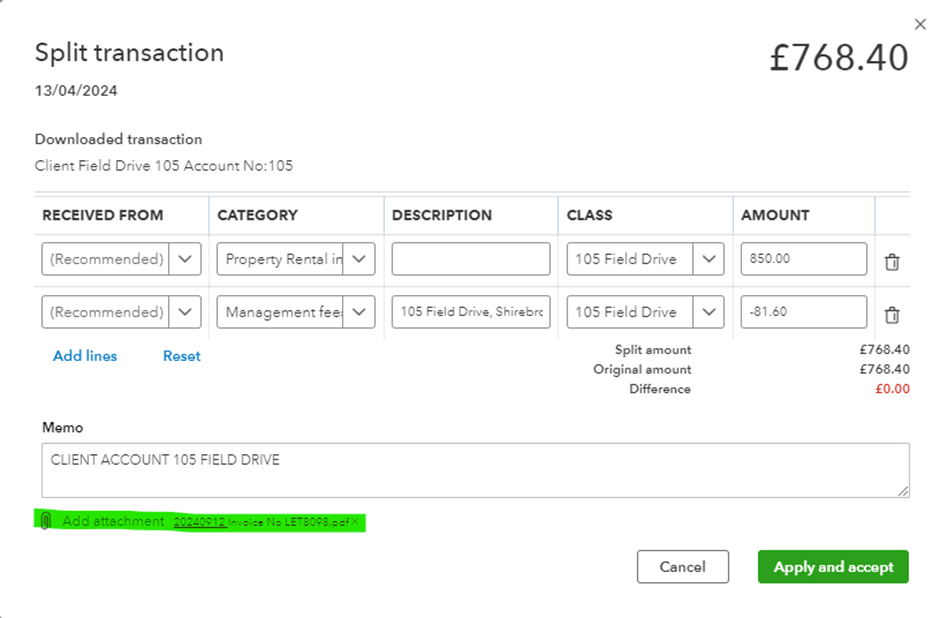

You should verify that you’ve entered the amounts correctly by ensuring that the Original Amount matches the Split Amount. If entered correctly, these amounts should be identical, resulting in a difference of £0.00.

You can now attach the letting invoice to the bank deposit for future reference. Simply click the Add Attachment icon and select the letting statement file.

Finally, click Apply and then select Accept.

If you have any questions or require any advice specific to your circumstances, please contact us at PJCO. You can book a free discovery call by clicking the link below!

Please get in touch on 01273 441187 or book a discovery call with one of our expert accountants.

Contact

You May Also Like…