VAT margin schemes

The VAT Margin scheme is when you charge your customers VAT on your sales, without incurring

unfair VAT liabilities on the sales that are eligible for a margin scheme. This is because HMRC has

introduced a fairer way to declare the VAT on sales for businesses that do not incur VAT on their

purchases.

How it works

Usually, as a VAT-registered business, you would charge VAT on the sale of goods. If you paid VAT on

the purchase, you could offset this VAT incurred against the VAT charged on sales, resulting in a VAT

liability or refund.

If no VAT was charged on the purchase of these goods, you will pay the full amount of this sales VAT

to HMRC. This could mean that due to being VAT-registered, you are having to charge your customers

more or even taking the hit yourselves and reducing the sales price.

With a VAT margin scheme, the VAT you pay is one-sixth of the difference between what you paid for

an item, and what you sold it for, rather than the full selling price. Due to this, you can only use the

margin scheme when you sell the following items:

- Second-hand goods: The goods must still be able to be used or used after repair.

- Works of art: Most works of art are eligible, although technical drawings, scenery for theatres

and hand-decorated manufactured items are not. - Antiques: Antique items must be goods over 100 years old.

- Collectors’ items: This includes collectors’ items such as stamps, coins and currency. Although

please note that not all collectable items are eligible for a margin scheme.

You cannot use a margin scheme if you were charged VAT on any of your purchases.

Example

Purchase some second-hand clothes for £1,500 at No VAT.

Sell these clothes for £2,000 including VAT at 20%.

Standard cash accounting

VAT on Sales: £400

VAT on Purchases: (£0)

VAT due to HMRC £400

VAT Margin Scheme

Purchase price: £1,500

Selling price: £2,000

Difference: £500

VAT on 1/6: £83.33

Therefore, being on this scheme saved VAT of £316.67.

If some of the items you buy and sell are not eligible for a margin scheme, you pay and charge VAT for

those items in the normal way

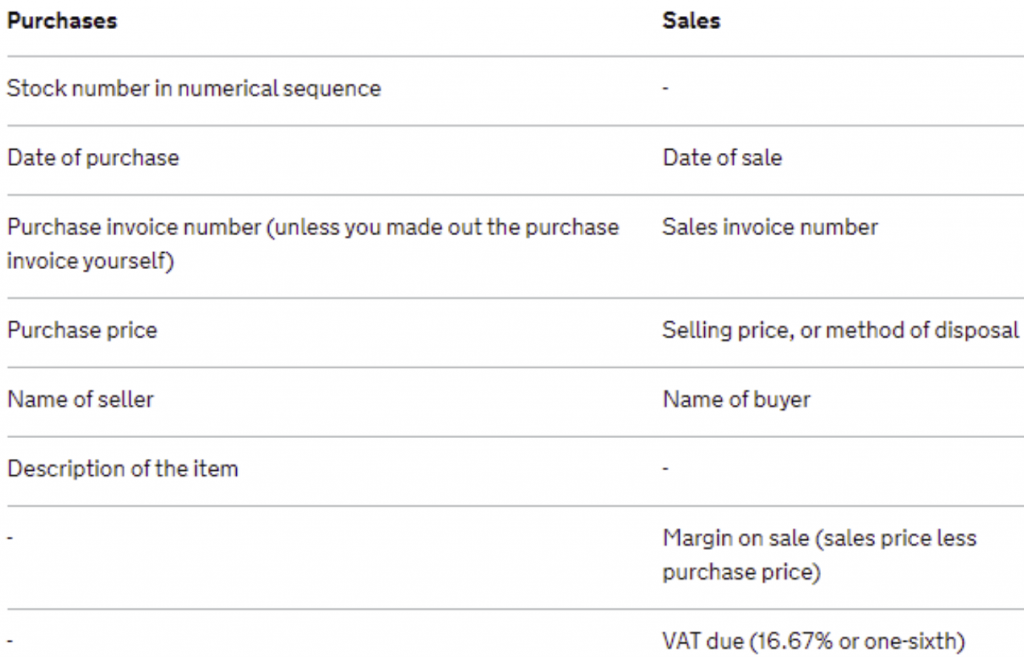

Record Keeping

VAT records must be kept for 6 years, and they must include copies of the purchase and sales invoices

for all items and a stock book that tracks each item sold under the margin scheme individually.

Invoices– To use the margin scheme, you must have invoices for each item that meet the VAT margin

scheme requirements. Including an invoice from the seller upon purchase, and a copy of the invoice

given to the buyer when sold.

Buying invoices must include:

- Date

- Seller’s name and address

- Your name and address/ business.

- Item description

- Total price

Selling invoices must include:

- Date

- Your name and address/ business.

- Invoice number

- VAT registration number

- Item description

- Total price (Do not show separate VAT).

- Detail of the margin scheme used (E.g., Second-hand goods).

Stock book – Please see the example below.

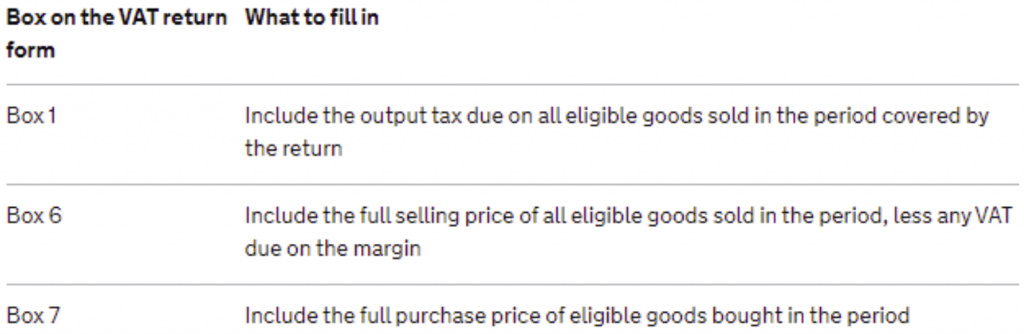

When submitting a VAT return you do not have to include margin scheme purchases, or sales, in

boxes 8 and 9 of your VAT return.

If you are unsure if a particular item is eligible for the margin scheme, please contact your client

portfolio manager here at PJCO.

Contact

You may also like…

VAT retail scheme

VAT flat rate scheme

VAT reverse charge

VAT for health professionals

Cross border VAT-Goods arriving UK

Cross border VAT- Goods leaving UK