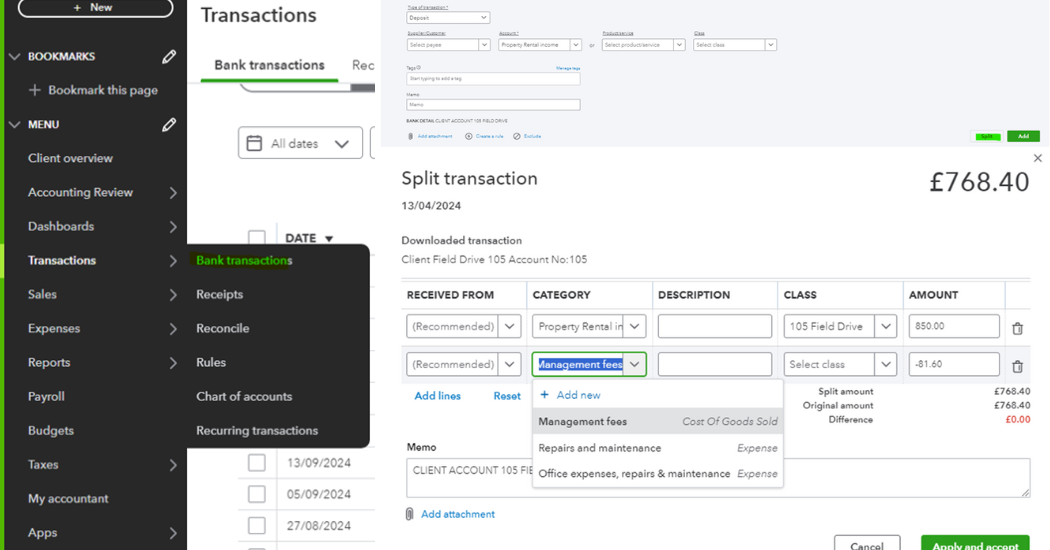

Letting agents typically deduct their fees directly from your rental income and deposit the net amount into your bank account. Here’s a quick guide on how to handle these transactions in QuickBooks Online. You will then see the net amount reflected in your bank account, and you’ll need to select the option to Split the…Read More

If you are currently letting out a FHL under the current scheme for this year you may be aware that in the 2024 Budget, the chancellor announced that from April 2025, the FHL tax regime would be abolished. This may raise concerns for those of you who are worried about the impact of reduced tax…Read More

Dext, Apron, and QuickBooks’ Receipt Snap each have unique strengths and weaknesses, making them suitable for different types of businesses. Dext Dext integrates seamlessly with Xero and QuickBooks, offering a comprehensive suite of products tailored for various clients and businesses. QuickBooks’ Receipt Snap Receipt Snap is a straightforward tool primarily suited for smaller companies or…Read More

Here are five reasons why investing in buy-to-let property in 2024 could be a smart move. Despite recent price drops, experts project that property prices will rise in the upcoming years. This presents an opportunity for investors to capitalise on potential capital appreciation, especially if they enter the market during a period of discounted prices.…Read More

As a newly VAT registered business you may find yourself asking, “When is my VAT due?” Understanding your VAT due date is essential to ensure compliance with HMRC regulations and avoid penalties. This post can provide some clarity on VAT due dates and offer tips to help you manage your VAT obligations effectively. VAT Due…Read More

After reading this post you will gain an understanding on the VAT deregistration process, including what makes you eligible and what you need to consider. VAT Deregistration Deregistration means that a business is no longer VAT registered and is not required to charge VAT on its goods and services, this also means that VAT cannot…Read More

Financial management for a rental business can be complicated. It can be confusing to know how to categorise your expenditure on the business and the tax treatment can be different depending on the type of expense. That’s why it is important to be able to distinguish between capital expenses and allowable business expenses. Capital Expenses:…Read More

If you buy, purchase, or inherit property with another individual, you must decide how you want to ‘hold’ the property together. Under UK law you can become a joint owner as either ‘joint tenants’ or ‘tenants in common’. The type of ownership you choose affects what you can do with the property if your relationship…Read More

Capital gains tax is the tax on any wealth (money/property) that is then used to make additional wealth or increase the value of that current wealth. For example, this could be through making capital improvements to your property to increase the value of this property. Everyone has an allowance of £6,000 annually that would enable…Read More

Salary sacrifice is a scheme that allows employees to exchange part of their salary in favour of savings for the future. The savings can take many non-cash benefit forms such as pension contributions. As employees are giving up a portion of their salary in favour of pension contributions their gross pay will decrease. Therefore, the…Read More

What does ‘allowable expense’ mean? An allowable expense is a cost solely for business purposes. Allowable expenses reduce a company’s taxable profits, which reduces its corporation tax liability (the amount the company owes the government in taxes). What would classify as an allowable expense? All expenses must have been incurred “wholly and exclusively” for…Read More

You may wish to know about increasing your tax relief for rental income. Whether you are an individual, in a partnership or part of a company, if you let properties, you can benefit from a tax deduction from rental income for replacing DOMESTIC ITEMS such as moveable furniture, household appliances, kitchen utensils and TV’s, etc.…Read More

In recent months, we’ve seen the base rate steadily increase by the Bank of England. Despite this making it more difficult for those on the housing market, this rate increase should only have a minimal effect on the benefits of investing in property. As interest rates increase, property prices should fall alongside them. This will…Read More

Gifting a property can be an attractive option for transferring ownership in the UK. However, it’s crucial to understand the tax implications and regulations surrounding property gifting. In this blog, we will address two common questions: whether capital gains tax (CGT) applies to gifted properties and whether it is possible to gift a property under…Read More

HMRC’s interest rates on overpaid or underpaid tax will increase from July 2023. HMRC’s interest rates on overpaid or underpaid tax will increase from July 2023, but it is not as simple as that: From 3 July 2023 the interest rates for Corporation tax will change to: From 11 July 2023, the interest rates…Read More