VAT Flat Rate Scheme

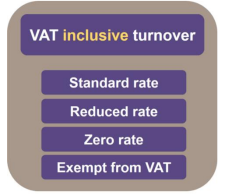

With the VAT flat rate scheme, you pay a fixed amount of VAT on your

gross turnover, the actual percentage you use will depend on the type

of business.

To start using the Flat Rate Scheme your business taxable turnover

has to be £150,000 or less.

You must leave the scheme if your turnover is over £230,000 including

VAT.

You will then have to wait 12 months before re-joining the scheme.

(Exempt items are still included in your VAT turnover).

Benefits:

- Less records.

- Gives you a 1% discount for the first 12 months from registration.

- Fewer rules to follow, and more certainty.

Drawbacks: - This scheme is not for you if you usually received repayments on the standard scheme.

- This scheme is not for you if you buy a lot of standard rated goods.

How do I use the flat rate scheme?

Charging customers – You continue to charge your customers at standard, reduced or zero rate,

so they do not see any different.

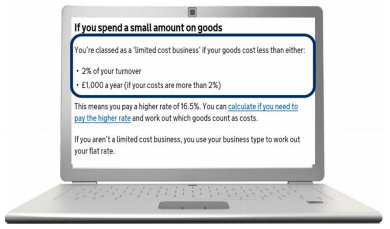

What is a limited cost business?

You should regularly check if you are a limited-cost business.

The 1% reduction still applies in your first year, even if you are a limited-cost business.

When completing your VAT return boxes 4 and 7 will be empty (reclaim on purchase), and

the only time purchases will be shown is when it is a capital purchase above £2K.

EXAMPLE 1

Standard

Net Turnover £100

Net purchase of standard-rated goods £60

Sales VAT due £20

VAT to reclaim £12

Total VAT due £8

Flat Rate Scheme

Gross Turnover £120

Gross purchase of standard-rated goods £72

FRS at 11% £13.20

Total VAT due £13.20

EXAMPLE 2

Standard

Net Turnover £100

Net purchase of standard-rated goods £10

Sales VAT due £20

VAT to reclaim £2

Total VAT due £18

Flat Rate Scheme

Gross Turnover £120

Gross purchase of standard-rated goods £12

FRS at 11% £13.20

Total VAT due £13.20

EXAMPLE 3 – Limited cost business

Standard

Net Turnover £100

Net purchase of standard-rated goods £2

Sales VAT due £20

VAT to reclaim £0.40

Total VAT due £19.60

Flat Rate Scheme

Gross Turnover £120

Gross purchase of standard-rated goods £2.40

FRS at 16.5% £19.80

Total VAT due £19.80

If you wish to speak to somebody that specializes in taking businesses onto compliant software packages. Get in touch with us for a free consultation to see if we can futureproof your company.

You may also like…

VAT for health professionals

VAT retail schemes

VAT reverse charge

Cross border VAT- Goods arriving UK

Cross border VAT- Goods leaving UK

VAT margin schemes