Taking Security Deposits from Customers in QuickBooks Online

If you take security deposits from customers then you will need to record them down so you know what you hold for different customers. QuickBooks makes it easy to record these so you can see at any time what you hold for each customer.

This blog deals specifically with deposits that are intended to be refunded back to the customer, typically after a period of use of an asset. Therefore if you take deposits which will typically be converted into revenue, for example after completion of works, then this isn’t for you.

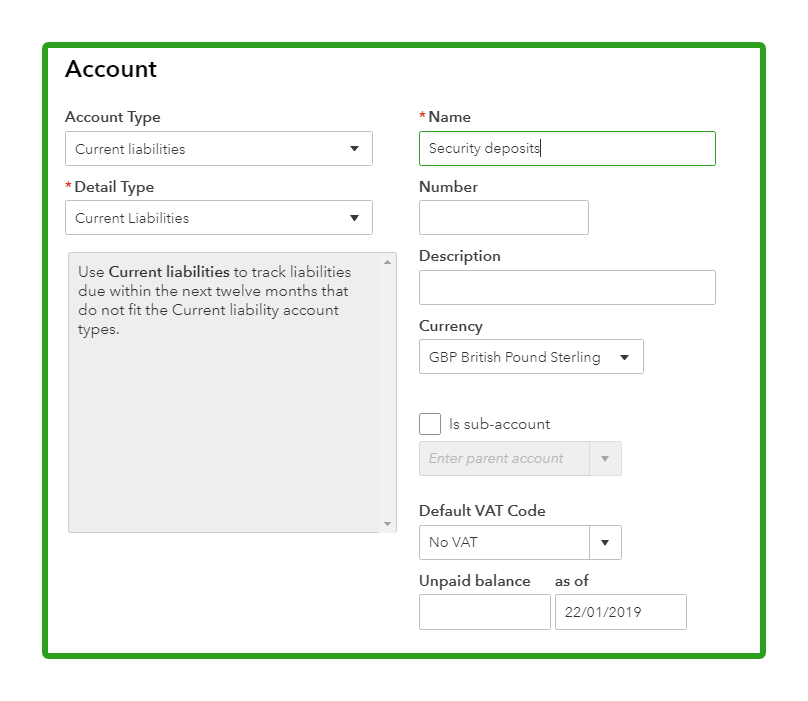

1. First, you will need to create a liability account for Security deposits.

To do this go to Accounting > New, then copy as shown:

2. How you allocate deposits depends on how you receive payment.

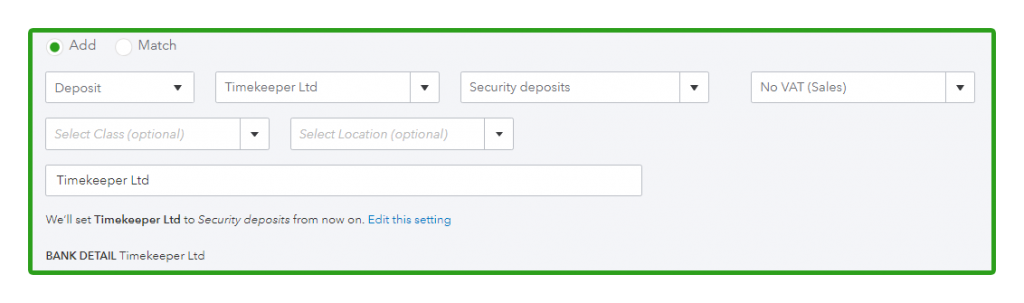

BACS transfer (deposit only – i.e. not a mixed payment)

Add as a deposit

The downside of this method is that it won’t show up in the customer account, so to see the deposit you have to go to a transaction report for the Security deposits account and then group rows/columns by customer. To get the transaction report to begin with you can go to Reports > Balance sheet > Security Deposits (click the balance) > Set reporting period (you will want the ‘to’ date to be today > Group by ‘Customer‘. Then ‘Save customisation’. You can then find the saved report under Reports > Custom reports.

BACS transfer (deposit only – i.e. not a mixed payment) or paid in cash

Add as a sales receipt

This option is better if you want to be able to see the security deposit listed as a transaction within the customer screen and/or you’d like to send them a receipt confirming you have received the deposit and what it is for.

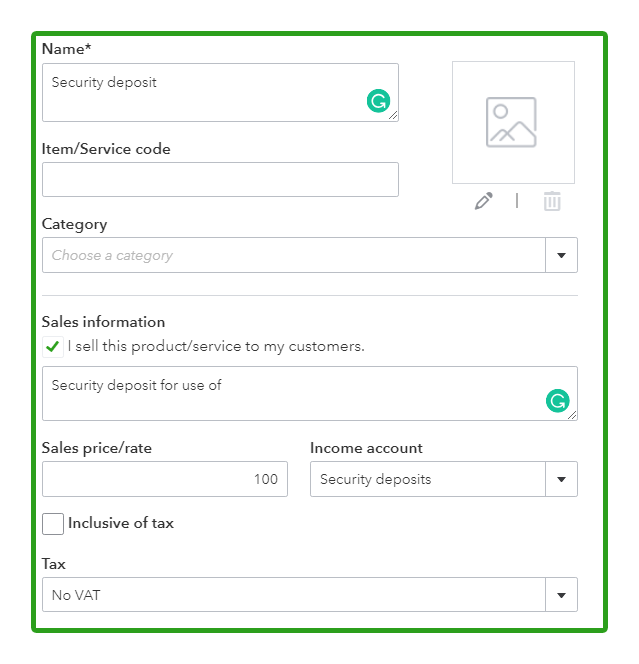

You will first need to set up a service called ‘Security deposit’. You can do this within the Sales R

- From the + icon, choose ‘Sales Receipt’

- Add details of the customer, date etc.

- Select in the ‘Deposit to’ box either the bank account the money is received or your cash account

- Add in your new service by clicking +New within the product/service box, select ‘Service’ and enter as follows (use your own description and rate):

- The ‘Income account’ should be the security deposits account created in step 1 of this blog

- Once you are finished you can save and send if you want the customer to receive a receipt, otherwise, save and close

- If the deposit was received by BACS then go to the banking screen and match up the sales receipt against the deposit

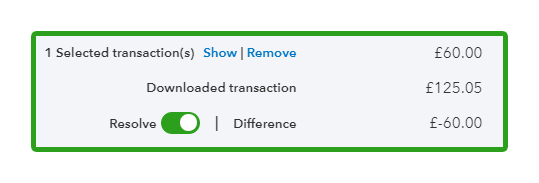

BACS transfer (mixed payment – i.e. payment of an invoice and the deposit)

If you aren’t bothered about seeing the deposit on the customer screen then:

- Go to the transaction in banking

- ‘Find match’

- Tick the invoice(s) that apply

- This will leave you with an outstanding balance which is the deposit, so toggle the ‘Resolve’ icon

- Add in a deposit, entering the customer as the payee, ‘Security deposits’ as the category and ‘No VAT’ as the tax

- This should leave a difference of £0 and then you can save

If you do want to see the deposit on the customer screen and/or send receipts then:

- Add in a sales receipt for the deposit using the method shown above

- Go to the transaction in banking

- ‘Find match’

- Tick the invoice(s) and sales receipt (deposit) that apply

- This should leave a difference of £0 and then you can save

3. Refunding deposits depends on how you make payment, where you want to see the refund and if you want to send a confirmation

BACS transfer

Option 1 – Expense

- Find the transaction in the banking screen

- Add as expense choosing the customer as the payee, ‘Security deposits’ as the category and ‘No VAT’ as the tax

As with allocating the initial deposit as a deposit, the expense would not show up on the customer screen, so to see the refund per customer you would have to go to Reports > Balance sheet > Security Deposits (click the balance) > Set reporting period (you will want the ‘to’ date to be today > Group by ‘Customer’

Option 2 – Add as Refund receipt

- From the + icon, choose ‘Refund receipt’

- Add details of the customer, date etc.

- Select in the ‘Refund from’ box either the bank account the money was paid from or your cash account

- Choose ‘Security deposit’ as the product/service

- Once you are finished you can save and send if you want the customer to receive a receipt, otherwise, save and close

4. Deposits retained

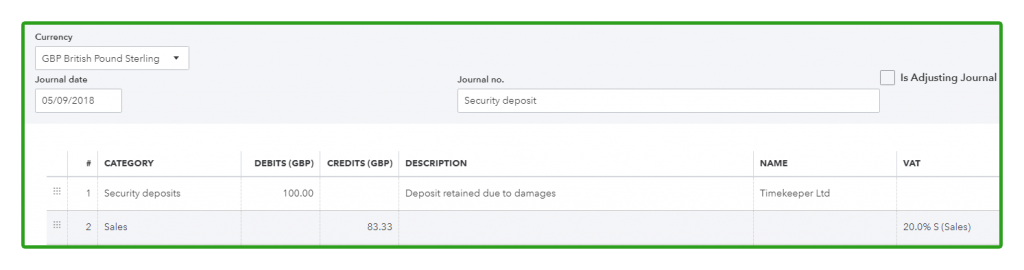

If you have only refunded a partial amount then you will be left with a balance in your security deposits account (created in step 1). This will need to be transferred to an income account using a journal entry.

If you are VAT registered then at this point the income retained will include VAT, so the journal must reflect that. If you are not VAT registered then the debit and credit columns can equal each other and the VAT column left blank.

You may also like…

Which QuickBooks is right for me?

Tracking stock in QB

Tracking job profitability in QB

QuickBooks CIS update

Using classes in QuickBooks

Using tags in QuickBooks